Blockchain Investment Trends in 2024

Introduction

Blockchain is a technology that uses computer code to create, maintain and update information shared by blockchain participants. Blockchain technology is a substitute for records maintained on a central database. Blockchain technology has the potential to transform various industries but there is a complex and rapidly evolving space.

Before investing we must consider factors such as – the specific use case of the blockchain project, its technological innovation and its potential for real-world adoption. They are mindful of the inherent volatility and risks associated with cryptocurrency investments. It’s also crucial to stay informed about regulatory developments in the blockchain and cryptocurrency space, as these can have an important impact on investment opportunities and risks.

Overview of rising blockchain investment and trends in 2023

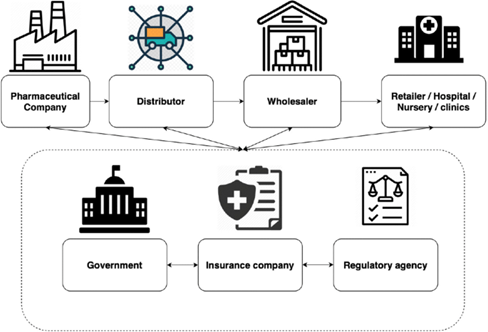

Blockchain technology and cryptocurrency investments continue to rise in 2023 along with the increasing interest from both individual and institutional investors. One of the prominent trends was the growing adoption of blockchain in various industries beyond finance such as – healthcare, supply chain management and entertainment.

NFTs have also gained significant attention with the help of art and gaming sectors seeing a surge in NFT-related activities. The development of central bank digital currencies by several countries is a key trend that has a potential shift towards digital forms of national currencies.

Regulatory developments played an important role in shaping the blockchain investment landscape with many countries working on establishing clearer frameworks for cryptocurrencies and blockchain technology. The year 2023 was of maturation and diversification for blockchain investments and trends along with broader recognition of the technology across various sectors and improved focus on sustainability and regulatory clarity.

Scope and objectives of the report

The scope and objectives of a report on blockchain investment could include a comprehensive analysis of the current state of blockchain investments, trends and their impact on various industries. The report could aim to provide insights into the following areas:

1. Market Analysis – This could involve examining investment inflows, market capitalization, and key players in the industry.

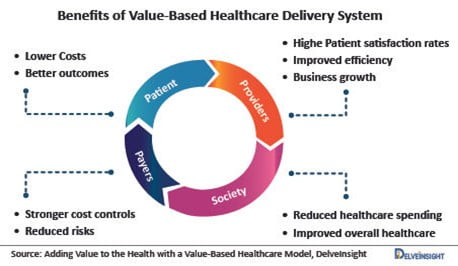

2. Industry Adoption – Explore the adoption of blockchain technology across different sectors, such as finance, healthcare, supply chain and entertainment.

3. Investment Trends – Identify and analyze the latest trends in blockchain investments which will include the shifts in investment strategies, the rise of new asset classes and the impact of regulatory developments on investment behaviour.

4. Technology Developments – The technological advancements in blockchain such as – scalability solutions, interoperability protocols and the evolution of consensus mechanisms will evaluate the potential impact of these developments on investment opportunities.

The objectives of the report will provide stakeholders with a comprehensive understanding of the current state of blockchain investments, key trends shaping the industry and the potential implications for businesses, investors and policymakers. This report aims to offer strategic insights and recommendations for navigating the evolving landscape of blockchain investments.

Key Investment Trends in 2024

DeFi Continues to Lead Investment

The DeFi market in 2023 has shown a dynamic pattern of outstanding flexibility and adaptability. The year marked significant progress along with the change towards greater clarity and stability in the regulatory framework. The evolution of Layer 2 technology brings substantial improvements in scalability and efficiency by laying the foundation for enhanced user experience and wider adoption.

As we move towards the year 2024 the potential adoption of DeFi by institutions is a key factor and this move to inject significant capital, expertise and credibility into the DeFi ecosystem facilitates growth and maturity. As DeFi progresses, it will remain a vibrant and important part of the broader financial sector that will show emerging regulatory and institutional norms.

Funding for DeFi protocols and platforms

In the year 2024, the funding for decentralized finance protocols and platforms will be strong which will reflect the sustained interest and investment in this sector. Several key trends and developments characterize the funding landscape for DeFi:

- Venture Capital Involvement – Traditional venture capital firms and institutional investors are increasingly participating in funding rounds and this trend signifies a growing acceptance of DeFi as a legitimate and disruptive force in the financial industry.

- Token Sales and Initial DEX Offerings – DeFi projects often raise funds through token sales and IDO which influence decentralized exchanges and token issuance platforms.

- Protocol Governance and Treasury Management – DeFi protocols often allocate a portion of their token supply to fund ongoing development, ecosystem growth and community initiatives.

- Decentralized Autonomous Organizations – DAOs play an important role in funding and governing DeFi projects and allow community-driven decision-making and allocation of resources, development of decentralized and participatory approaches to funding and project management.

- Security and Audits – Investors and users are increasingly prioritizing security and robustness in DeFi protocols. Funding is directed towards security audits, bug bounties, and insurance mechanisms to mitigate risks and enhance trust in these platforms.

- Regulatory Considerations – DeFi projects are navigating evolving regulatory landscapes, and funding efforts often include legal and compliance considerations to ensure sustainable operations within regulatory frameworks.

The funding for DeFi protocols and platforms in 2024 reflects a maturing ecosystem with a diverse range of funding sources, a focus on security and compliance and an increasing convergence of traditional and decentralized finance.

Growth of Decentralized Exchanges

The growth of decentralized exchanges (DEXs) in 2024 has been outstanding with these platforms which makes it constant to gain traction in the cryptocurrency space. Several factors have contributed to this growth:

Increased Adoption – More users are embracing decentralized finance and seeking alternatives to traditional and centralized exchanges. This has led to a surge in the number of participants using DEXs for trading and accessing various financial services.

Enhanced User Experience – DEX platforms have been focusing on improving user interfaces and overall user experience that makes it easier for individuals to navigate and utilize these decentralized trading venues.

Interoperability and Cross-Chain Solutions – The development of interoperability protocols and cross-chain solutions has facilitated the seamless transfer of assets across different blockchains, expanding the reach and utility of DEXs.

Regulatory Developments – Regulatory clarity in some jurisdictions has provided a more stable environment for DEXs to operate, leading to increased confidence among users and investors.

The integration of environmentally conscious strategies within the DEX ecosystem has not only addressed environmental concerns but has also positioned DEXs as leaders in promoting sustainable technology. The growth of DEXs in 2024 has been driven by a combination of technological advancements, regulatory developments and demand for decentralized financial services.

Increased Institutional Investment

An institutional investor is a company or organization that invests money on behalf of other people. Mutual funds, pensions and insurance companies are examples. Institutional investors often buy and sell substantial blocks of stocks, bonds or other securities.

The institutional investment in the cryptocurrency space has surged, reshaping the industry in profound ways. This influx of institutional capital has significantly increased the demand for market liquidity and stability, reducing volatility and enabling larger trades.

It has encouraged the development of a diverse array of investment products tailored to institutional investors which contain cryptocurrency index funds and structured products. The convergence of traditional finance and the cryptocurrency market has enhanced with established financial institutions offering custody and trading services for digital assets. Institutional involvement has also influenced regulatory discussions that lead to a more informed approach to cryptocurrency regulation. Traditional firms allocate more to the blockchain.

Rise of Blockchain Investment Funds

The rise of blockchain investment funds has been prominent which reflects the increase in the institutional interest in blockchain technology and digital assets. These funds have involved significant capital from institutional and accredited investors seeking exposure to the blockchain and cryptocurrency sectors.

The proliferation of blockchain investment funds has provided investors with diversified exposure to various aspects of the blockchain ecosystem that contains – infrastructure projects, decentralized finance protocols and Web3 applications. These funds have played an essential role in funding early-stage blockchain startups and fostering innovation within the industry. Blockchain technology continues to progress and integrate with traditional finance and the role of specialized blockchain investment funds is poised to remain main in driving innovation, fostering expertise and shaping the future of investments.

Surge in Web3 and Metaverse Startup Funding

There has been a remarkable surge in funding for Web3 and Metaverse startups which reflects the growing enthusiasm and investment in these innovative sectors. This surge in funding has been determined by – the confluence of factors, including the increasing mainstream adoption of Web3 technologies, the rise of virtual and augmented reality applications and the expanding ecosystem of decentralized applications and platforms.

The surge in funding for Web3 and Metaverse startups has not only provided these companies with the necessary capital to innovate and grow but has also provided a broader recognition of the transformative potential of these technologies.

This surge in funding has also contributed to the development of a vibrant and dynamic ecosystem, collaboration, creativity and technological advancement within the Web3 and Metaverse spaces. As these sectors continue to progress and the surge in funding in 2024 is expected to have a last that will impact on the development and mainstream adoption of Web3 and Metaverse technologies.

Social Media and Creator Tools

Social media and creator tools are important for DeFi projects to gain attention from audiences that will fund them and social media marketing for DeFi projects involves generating awareness of a DeFi project to make it stand out among the many DeFi projects that are available.

In 2024 the emergence of DeFi platforms was custom-made to the needs of content creators that offered features such as – tokenized memberships, NFT integrations and decentralized content monetization mechanisms. These platforms allow the creators to engage directly with their audiences, and access new revenue streams through decentralized financial instruments.

The mix of social media and creator tools with DeFi has not only expanded the possibility of decentralized finance but has also empowered individuals to influence the digital presence for financial inclusion and economic empowerment. As it continues to develop it is expected to understand the relationship between content creators, social media platforms and financial ecosystems and value exchange.

Regional Analysis of Blockchain Investments

The regional variations in blockchain investments for decentralized finance have been apparent along with Asia, Europe and North America that were standing out as key hubs for DeFi-related development. These regions have attracted investment in DeFi projects which reflect global interest in decentralized financial applications and services. Asia has seen important activity in DeFi that is driven by the presence of vibrant cryptocurrency and blockchain ecosystems as well as growing interest from both retail and institutional investors.

Regulatory developments and government support in certain areas have also played a role in shaping the direction and growth of DeFi investments, contributing to the observed regional nuances in the DeFi investment landscape. As DeFi continues to gain traction worldwide, these regional trends are likely to influence the evolution and adoption of decentralized finance, with different areas contributing to the overall development and innovation within the DeFi space. In 2024, the blockchain investment landscape has changed dramatically which will showcase the rapid growth of DeFi and the expansion of NFTs into areas like real estate and intellectual property.

Investor Perspectives and Outlook

Investor perspectives on decentralized finance have been formed by a combination of passion for the capability of DeFi applications and services as well as a growing emphasis on risk management and regulatory compliance. Investors have been intension of the innovative nature of DeFi that will recognize its potential to disrupt traditional financial systems and create new opportunities for financial inclusion and efficiency.

As the growth increases the investors will be optimistic about the future of DeFi which will also lead to the maturation of the ecosystem. They are closely observing the regulatory developments and seeking opportunities that will create a balance of innovation with risk management. The investors are keenly interested in the evolution of DeFi infrastructure, scalability solutions and the integration of decentralized finance with traditional financial systems. This will reflect a balance of optimism, caution and a strong focus on the long-term potential for DeFi.

Blockchain Verticals to Watch in 2024

In the year 2024, several blockchain verticals are expected to gain traction and attention. Here are a few to watch:

- Decentralized Finance (DeFi) – DeFi has been a major trend in recent years and it’s likely to continue growing in 2024 and there are new DeFi protocols, lending platforms and innovative financial products built on blockchain.

- Non-Fungible Tokens (NFTs) – NFTs have already made a big splash in the art and entertainment industries. In 2024, NFTs will be used in new and unexpected ways, such as – gaming, real estate and digital identity.

- Supply Chain Management – Blockchain technology is being used to improve transparency and traceability in supply chains and this trend is likely to continue in 2024, with a focus on sustainability, ethical sourcing and reducing fraud.

- Central Bank Digital Currencies (CBDCs) – Many central banks around the world are exploring the possibility of issuing their digital currencies and the progress in this area along with some countries launching pilot programs or even fully implementing CBDCs.

- Governance and Voting – Blockchain-based voting systems and governance mechanisms are gaining attention for their potential to improve transparency and security in elections and decision-making processes.

From DeFi and NFTs to supply chain management, CBDCs and governance solutions the capability of these applications of blockchain technology are diverse. As the year progresses, it will be interesting to observe how these verticals develop and intersect the future of decentralized and transparent systems.

Regulatory Environment and Its Impact

The regulatory environment continues to have a significant impact on blockchain investment trends. Regulatory clarity and frameworks play a crucial role in shaping investor sentiment and influencing the direction of blockchain investments. Clear and supportive regulations have confidence in institutional and retail investors and will lead to increased participation and capital inflows into the blockchain space.

Compliance-focused solutions, such as – Regulatory Technology and decentralized finance platforms that prioritize regulatory adherence are likely to increase attention from investors seeking to mitigate regulatory risks.

The harmonization of global regulatory standards and cross-border collaboration can facilitate smoother investment flows and a more conducive environment for blockchain investment on a global scale. The regulatory landscape remains an essential factor influencing blockchain investment trends in 2024 which will shape the trajectory of the industry and the allocation of capital.

Challenges and Risks for Blockchain Startups

Blockchain startups continue to face a range of challenges and risks that influence blockchain investment trends. Some of the key challenges and risks for blockchain startups in 2024 include:

- Regulatory Uncertainty – Regulatory uncertainty may lead to hesitancy among investors and hinder the growth of blockchain startups.

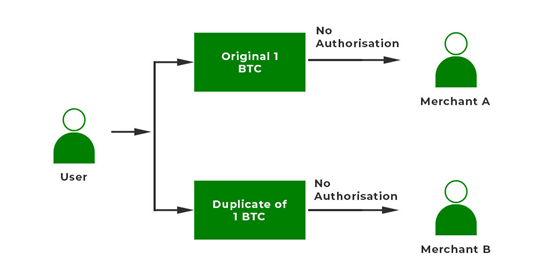

- Security Concerns – Startups in the blockchain space must address potential vulnerabilities, such as smart contract exploits and network attacks, to build trust and credibility among investors and users.

- Scalability and Interoperability – The ability to handle a high volume of transactions and seamlessly interact with other blockchain networks is crucial for the widespread adoption of blockchain solutions.

- Market Volatility – The inherent volatility of cryptocurrency markets can impact the financial stability of blockchain startups and those holding significant digital assets.

- Talent Acquisition and Retention – Recruiting and retaining skilled professionals in blockchain development, cryptography and cybersecurity can be challenging.

- User Adoption – Convincing mainstream users and businesses to adopt blockchain-based solutions remains a hurdle for startups and overcoming user skepticism and integrating blockchain technology into existing workflows and systems requires strategic planning

Facing these challenges and modifying the associated risks is vital for blockchain startups to attract investment and thrive in 2024. Startups that validate resilience, innovation and a proactive approach to risk management are more likely to capture investor interest and contribute to the blockchain industry.

Conclusion

The blockchain industry has shown significant growth and diversification along with decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain management, central bank digital currencies (CBDCs) and governance solutions emerging as prominent verticals. These developments reflect a maturing ecosystem with a wide range of funding sources and a growing emphasis on regulatory compliance.

The regulatory environment remains to play an essential role in developing blockchain investment trends, influencing investor sentiment and capital inflows. Regulatory clarity and supportive frameworks are essential for boosting the confidence of both institutional and retail investors, particularly in compliance-focused solutions such as – DeFi platforms.

Blockchain startups face various challenges and risks in 2024 that will include – regulatory uncertainty, security concerns, scalability, market volatility, talent acquisition, and user adoption. Overcoming these obstacles will be crucial for startups to attract investment and contribute to the industry’s advancement.

We recommend that it is important to stay updated on regulations, prioritize security, focus on scalability and interoperability, recruit and retain top talent, integrate sustainability practices and embrace innovation and proactive risk management to attract investment and contribute to industry advancement.

You must be logged in to post a comment.